Retirement is a time for relaxation and enjoying the fruits of your long years of labor, right? However, imagine facing this phase without sufficient savings, it can seem a daunting prospect. The following insights will take you through the stark realities of retiring without money, yet also offer potential solutions to manage such a situation. This article looks into the complications, repercussions and even the unexpected opportunities that might arise when you find yourself in retirement and financially unstable. So, together let’s navigate these turbulent waters and find ways to turn the tide.

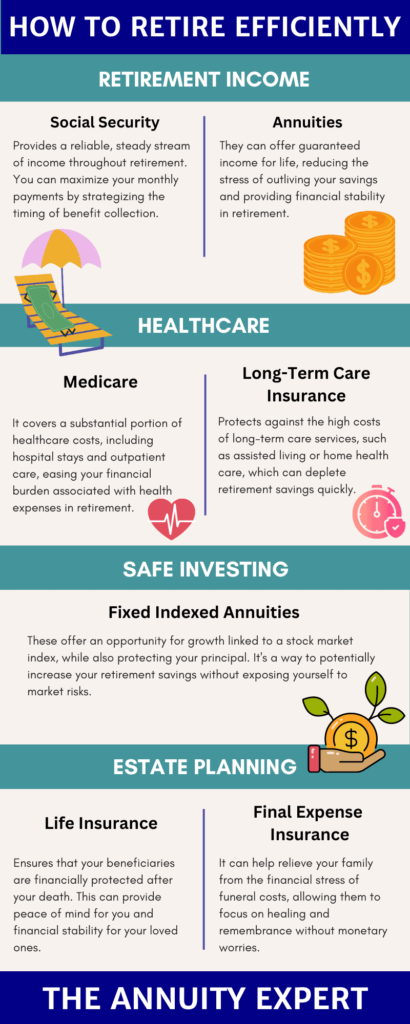

This image is property of www.annuityexpertadvice.com.

Check out our recommended retirement gifts!

- Understanding Retirement and Financial Need

- The Reality of Retiring without Money

- Government Support and Social Security

- Medicaid and Other Health Care Options

- Housing Considerations

- Managing Basic Needs

- Potential for Ongoing Employment

- Dealing with Debt after Retirement

- Family Support and Inheritance

- Planning Ahead and Avoiding Financial Strain

Understanding Retirement and Financial Need

When it comes to retirement, understanding the financial need and requirements is essential. The age at which you retire can play a significant role in how much money you will need.

Retirement age and financial requirements

The retirement age, often set at 65 in many countries, is the point at which you stop working and start living off your savings, pensions, and Social Security. The retirement age is not just a random number but a key determinant of your financial requirements. Retiring sooner means a longer retirement period, which requires more savings, while retiring later can give you more time to build a bigger nest egg. Therefore, identifying the right retirement age is the first step in gauging your retirement financial need.

Average retirement savings and considerations

Most financial planners advise that you should aim to replace about 70-80% of your pre-retirement income in retirement, but how much is that in actual dollar terms? According to the U.S. Federal Reserve, the average savings of families where the head of the household is between 55 and 64 years old is $134,000. While this might seem a sizeable amount, when spread across 20 or 30 years of retirement, it barely covers the basics. Hence, while average retirement savings can provide a rough guide, it’s crucial to take into account your lifestyle, health, and expectations from retirement, among others to determine how much you might need.

Impact of no savings in retirement

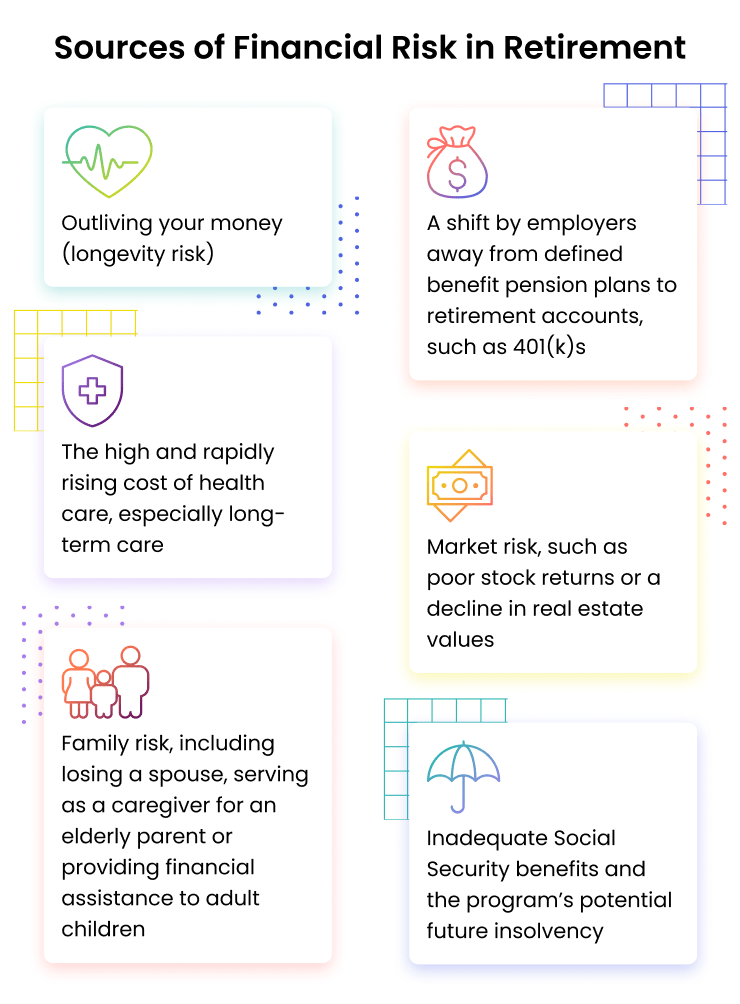

Having no savings in retirement can lead to devastating effects. With no income other than a modest Social Security check, you may struggle to cover basic living costs. It puts you in a precarious financial situation, leaving you vulnerable to unexpected expenses and reliant on government benefits or family support.

The Reality of Retiring without Money

Retiring without money can be a harsh reality filled with financial strain and drastic lifestyle changes.

The financial strain and its effects

The financial strain of retiring without money can lead to a downward spiral in your quality of life. You may struggle to pay for necessities like food, housing, and healthcare. It can also lead to stress and anxiety, further affecting your physical and mental health. The silver lining here is that awareness of the problem enables you to take corrective measures early.

Possible lifestyle changes and adjustments

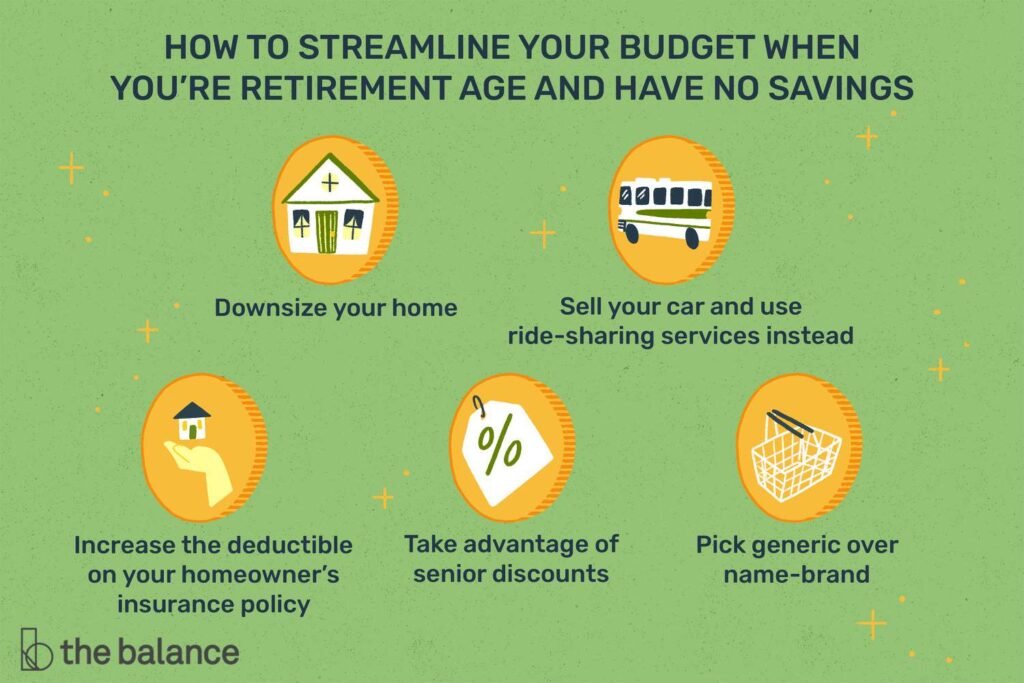

Retiring without money might mean needing to make significant lifestyle changes and adjustments. These could include downsizing your home, eliminating non-essential expenses, or even going back to work part-time. While it can be a challenging transition, these changes can help stretch your limited resources and are crucial to surviving a retirement period without savings.

Check out our recommended retirement gifts!

Government Support and Social Security

Thankfully, even if you don’t have personal savings, government support, and Social Security can provide some relief.

Eligibility and process of claiming Social Security

Social Security provides a monthly income based on your lifetime earnings. To be eligible, you need to have earned a certain amount of credits, typically accumulated over a working life. Claiming Social Security is a simple process that involves filing an application online, via phone, or through a social security office.

Amount of income provided by Social Security

The income provided by Social Security varies depending on your earnings history and when you start taking benefits. In 2020, the average monthly benefit amount was around $1,500. While this can provide a safety net, it is rarely enough to maintain a comfortable lifestyle.

Limitations and insufficiencies of government assistance

Despite the relief that government assistance provides, it has its limitations. Social Security was never intended to be the sole source of retirement income, and the benefits might not cover all of your expenses. This realization highlights the importance of personal savings for retirement.

Medicaid and Other Health Care Options

Affording healthcare in retirement can be a huge challenge, especially without savings. Medicaid and other insurance options can provide some safeguards.

Eligibility for Medicaid and application process

Medicaid provides healthcare coverage for low-income individuals. Eligibility is based on income and assets, and the application process can be done online or through local Medicaid offices. It’s important to know that each state has different rules for Medicaid, so check the guidelines in your locale.

Coverage and limitations of Medicaid

Medicaid coverage can be extensive, including hospital stays, doctor visits, and even long-term care. However, it may not cover every health service, and there may be limitations on the choice of providers.

Other options for health insurance in retirement

Other than Medicaid, other healthcare options include Medicare, private health insurance, or employer-sponsored retiree health insurance. Choosing the right healthcare coverage can help manage potentially high healthcare costs in retirement.

This image is property of www.annuityexpertadvice.com.

Housing Considerations

Housing is another major expense in retirement. You may face challenges securing a mortgage loan, and other options also bring their own sets of pros and cons.

Ineligibility for mortgage loans

Obtaining a mortgage in retirement can be difficult. Without steady employment income, lenders may be wary to grant a loan. However, it’s not impossible if you have other sources of income and a good credit history.

Renting versus owning

The decision of renting versus owning in retirement is a complex one. Owning can provide stability, but it also comes with responsibilities like maintenance, taxes, and insurance. Renting, while flexible, might also mean uncertainty of rent increments and potential moves.

Public housing and other affordable options

For low-income retirees, public housing or subsidized housing might be feasible options. There are also programs that provide tax credits or vouchers for private rentals. Exploring these alternatives can give you a secure place to live even with limited resources.

Managing Basic Needs

Everyday essentials like groceries and personal items also need to be carefully managed in a budget-tight retirement.

Budgeting for groceries and personal expenses

Creating a budget for retirement is critical. Prioritizing essential expenses like food, medication, and utilities can help stretch your limited income as far as it can go.

Benefit of food stamps and other programs

Government programs like food stamps and utility assistance can provide much-needed help. These programs are often income-based and can significantly reduce your monthly expenditures.

Thrift and discount options

Looking for sales, using coupons, and shopping at thrift stores are also ways to stretch your retirement dollars. Every saved penny contributes to a more sustainable retirement lifestyle.

This image is property of www.thebalancemoney.com.

Potential for Ongoing Employment

Just because you’re retired doesn’t mean you can’t still work. Part-time jobs or freelance work can supplement your income.

Part-time job opportunities for seniors

There are many employment opportunities for seniors, many of which can be fulfilling and flexible. Whether it’s retail, customer service, or even pet sitting, these jobs can provide extra income and a sense of purpose.

Freelance or remote work prospects

Freelancing or remote work offers flexibility and can often be done from home. From writing and graphic design to consulting or tutoring, these opportunities can turn skills and experience into income.

Challenges of finding work post retirement

Finding work post retirement can present challenges. Ageism, the need for updated skills, and health issues are potential barriers. However, with determination and flexibility, you can still find viable opportunities.

Dealing with Debt after Retirement

Carrying debt into retirement can severely strain your finances, especially without savings.

Inability to service debts

Without substantial savings or income, servicing debt in retirement can be difficult. This can lead to mounting fees, high interest rates, and financial stress.

Potential for bankruptcy and its implications

In severe cases, bankruptcy might be an option. While it can provide some relief, it also has severe consequences. It can damage your credit and make securing loans or housing difficult in the future.

Debt settlement and negotiation options

Rather than jumping straight to bankruptcy, consider negotiating with creditors or seeking a debt settlement. Many creditors prefer recouping some funds rather than seeing a debtor go into bankruptcy, so these options could work in your favor.

This image is property of www.annuity.org.

Family Support and Inheritance

Family support and inheritance can provide financial relief but come with their own set of considerations and risks.

Considerations for financial aid from family

Receiving financial aid from family can be a blessing, but it’s important to consider the potential strain on their finances. It’s also important to keep expectations realistic and keep open communication.

Risks and implications of relying on inheritance

Reliance on an inheritance can be a risky strategy. Inheritances are not guaranteed, they can be delayed, or they could be less than expected. It’s best not to count on it for primary retirement income.

Planning Ahead and Avoiding Financial Strain

The best way to avoid financial strain in retirement is to plan ahead.

Importance of pre-retirement financial planning

Good financial planning helps ensure you have sufficient funds for the lifestyle you want. It includes setting savings goals, creating a retirement budget, planning for healthcare costs, and more.

Potential strategies for savings and investment

Investing in retirement accounts like a 401(k) or IRA, diversifying investments, and creating a retirement savings plan are strategies to build your nest egg. Finding ways to save, no matter how small, can add up significantly over time.

Avoiding financial mistakes commonly made by retirees

Avoiding financial mistakes can also contribute to a financially secure retirement. These include retiring too early, not planning for healthcare expenses, or not adjusting spending habits in retirement.

In conclusion, retiring without money can present significant challenges and adjustments. It’s essential to understand your retirement needs, explore government and community assistance programs, manage your resources well, and plan ahead for a secure and comfortable retirement.