Retiring is such a thrilling chapter of your life, filled with dreams of relaxation and exploration. But as you edge closer to this milestone, it’s vital to consider how the tax landscape might affect your nest egg. “What Are The Tax Implications Of Retiring In Different States?” dives into the diverse tax policies across the United States and how they can impact your retirement finances. From income taxes to property and sales taxes, this guide will illuminate the financial pros and cons of retiring in various states, helping you make an informed decision that’s right for your golden years. Have you ever wondered about the tax implications of retiring in different states? Maybe you’re eyeing Florida’s sunny beaches or Colorado’s serene mountains as your retirement haven, but you’re unsure about the tax picture that comes with it. Choosing your retirement location is a significant decision, and understanding the tax landscape can make a notable difference in your financial well-being.

Check out our recommended retirement gifts!

Why State Taxes Matter in Retirement

Retirement is a chance to enjoy the fruits of your labor, and picking the right state to settle in can either ease or burden your finances. While federal taxes remain constant across the country, state taxes can vary widely, affecting your income, property, sales, and estate taxes. This variability can have substantial implications on your retirement savings and living costs.

Income Taxes

Income taxes are one of the most significant factors to consider. Some states tax income heavily, while others have no income tax at all. For instance, Florida and Texas are known for their lack of state income tax, which can be a substantial relief for retirees earning Social Security and drawing from retirement accounts.

Property Taxes

For retirees who plan to own a home, property taxes can add a significant burden. States like New Jersey and Illinois may have high property taxes that could offset some of the benefits you might gain from lower state income taxes. Knowing the property tax rates can help you anticipate annual costs and plan accordingly.

Sales Taxes

Sales taxes are another crucial piece of the puzzle. States like Tennessee have high sales taxes that can increase the cost of living, while others like Delaware have no sales tax. This can considerably impact your day-to-day expenses, especially if you plan to spend your retirement traveling or indulging in other activities.

Estate and Inheritance Taxes

Estate and inheritance taxes can affect what you leave behind for your heirs. Few states impose these taxes, but if you’re planning on leaving a significant estate, understanding these taxes can be crucial for estate planning. States like Maryland impose both an estate and inheritance tax, which can be a double blow to your beneficiaries.

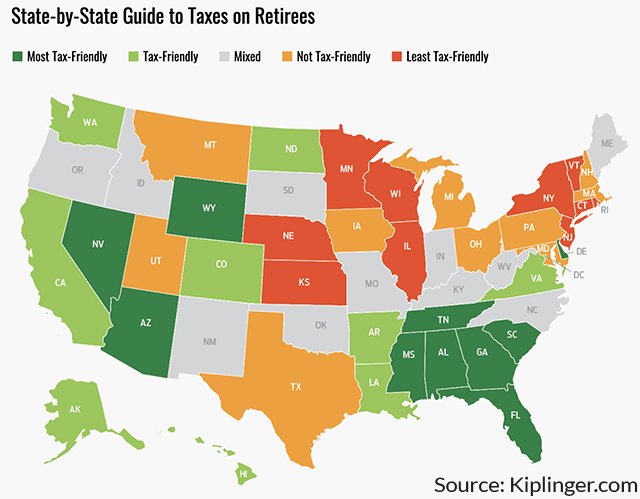

State Comparisons – Tax-Friendly vs. Tax-Heavy States

It’s essential to compare tax-friendly states with those that could be considered tax-heavy, so you can make an informed decision. Here we break down some examples:

Tax-Friendly States

Florida

Florida is famous for its lack of state income tax, which makes it highly attractive for retirees. The state also has no estate or inheritance tax, though it does impose a 6% sales tax and has varying property tax rates across counties.

Texas

Texas also boasts no state income tax and no estate tax, but it does have high property taxes and a relatively high sales tax rate of 6.25%, which can have implications for everyday expenses.

Wyoming

Wyoming offers a triple win for retirees: no state income tax, low property taxes, and no estate or inheritance tax. With a low sales tax rate of 4%, it’s one of the friendliest states regarding taxes.

Tax-Heavy States

California

California imposes a progressive state income tax that is among the highest in the nation, reaching up to 13.3% for the highest earners. The state also has high property taxes and a high sales tax, which can significantly impact retirees’ budgets.

New Jersey

New Jersey’s high property taxes are infamous, averaging around 2.42% of a home’s value. The state also has an inheritance tax and an estate tax, making it less friendly for retirees looking to leave assets to their heirs. However, New Jersey does offer a generous income tax exemption for retirement income.

New York

New York has high state income taxes and property taxes, and although it exempts Social Security from state taxes, other forms of retirement income are subject to the state’s high income tax rate. The state also has an estate tax but no inheritance tax.

Table Comparison of Select States

To make things straightforward, here’s a comparative table showing critical tax aspects of these states:

| State | Income Tax | Property Tax (Avg) | Sales Tax | Estate Tax | Inheritance Tax |

|---|---|---|---|---|---|

| Florida | None | 0.83% | 6.00% | None | None |

| Texas | None | 1.83% | 6.25% | None | None |

| Wyoming | None | 0.61% | 4.00% | None | None |

| California | Up to 13.3% | 0.74% | 7.25% | Yes | None |

| New Jersey | Up to 10.75% | 2.42% | 6.625% | Yes | Yes |

| New York | Up to 8.82% | 1.69% | 4.00% | Yes | None |

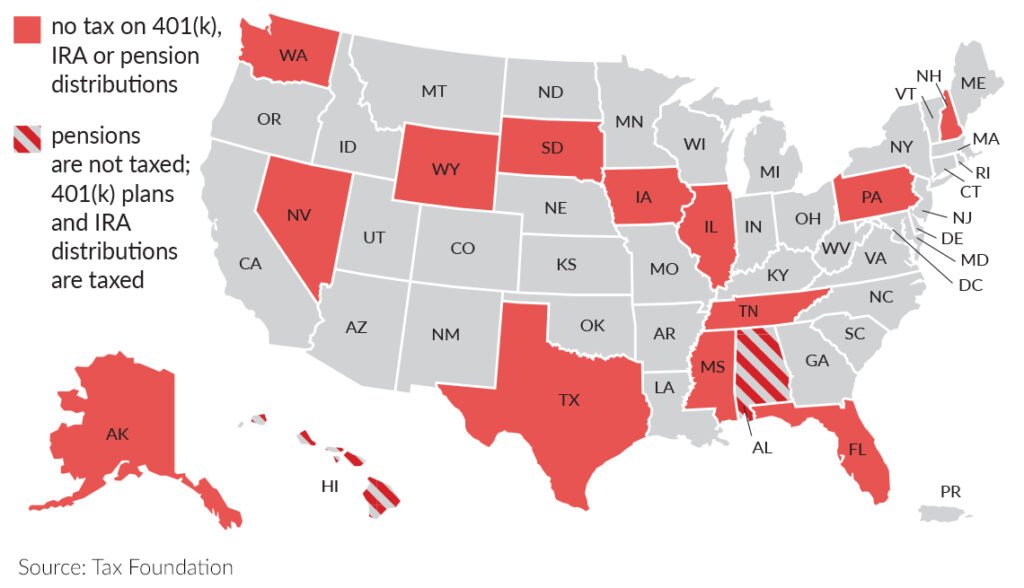

This image is property of www.aarp.org.

Check out our recommended retirement gifts!

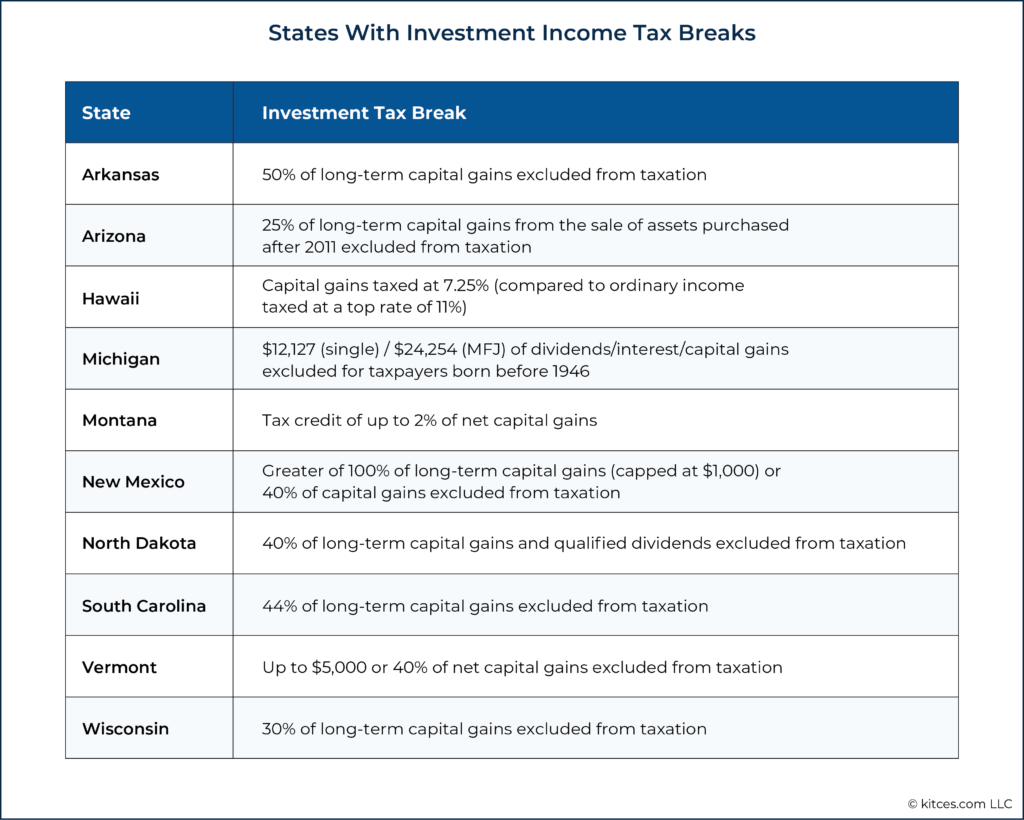

Retirement Income Sources and State Taxes

Different states have varying rules about taxing retirement income. Here’s a look at how common retirement income sources are taxed:

Social Security Benefits

While federal taxes apply to Social Security benefits based on your combined income, states handle this differently. Fortunately, most states don’t tax Social Security benefits.

States That Do Tax Social Security: Eleven states tax Social Security benefits. These include Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, and Vermont, although many have exclusions based on income or age.

States That Don’t Tax Social Security: The rest either don’t have income taxes or don’t tax Social Security benefits, making them more favorable for retirees.

Pension Income

Pension income, both private and public, may be taxed differently state by state. The tax treatment can significantly affect retirees depending on their primary retirement income source.

Tax-Free States: States like Illinois, Mississippi, and Pennsylvania don’t tax pension income, making them appealing for retirees relying heavily on pensions.

Taxable States: States like California and New York tax pension income as ordinary income, which can be costly depending on the state’s tax brackets.

401(k) and IRA Withdrawals

Withdrawals from 401(k) plans and IRAs are typically taxed as ordinary income at the federal level. States may mirror this treatment or offer exemptions to lower the tax burden on retirees.

Exemptions & Deductions: States such as New York offer exclusions for retirement account withdrawals, which can facilitate lower taxes compared to states that tax withdrawals as regular income.

Personal Considerations and Cost of Living

Tax implications are vital, but other personal considerations could influence your decision. These include:

Healthcare Costs and Access

Healthcare is a significant consideration in retirement. Some states offer more affordable healthcare options and better access to medical facilities, affecting the overall retiree experience. States like Florida and Arizona have robust healthcare systems tailored to retirees.

Climate and Lifestyle

Weather preferences and recreational opportunities can also affect where you want to retire. Warm states like Florida and Arizona attract retirees looking to escape the cold, while states like Colorado offer abundant outdoor activities.

Proximity to Family

Being close to family and friends can also play a crucial role. The social support and happiness derived from being near loved ones can outweigh some of the tax disadvantages of a particular state.

Overall Cost of Living

Finally, the overall cost of living, including housing, groceries, utilities, and transportation, is crucial. Even in states with low taxes, a high cost of living can erode your retirement savings.

This image is property of ei.marketwatch.com.

Strategies to Mitigate Tax Burdens

If you’re set on a state but worried about taxes, there are strategies to minimize your tax burden:

State Tax Credits and Deductions

Many states offer tax credits and deductions for retirees, such as homestead exemptions that lower property taxes for seniors or state tax credits for retirement income.

Charitable Contributions

Charitable contributions can provide tax deductions at both federal and state levels. Donating to qualified organizations can reduce taxable income while supporting causes you care about.

Tax-Advantaged Accounts

Using tax-advantaged accounts like Roth IRAs can provide tax-free income in retirement, helping you manage your tax burden regardless of your state.

Residency Strategies

Some retirees split time between states or establish residency in tax-friendly states while maintaining a second home elsewhere. However, ensure you meet the legal requirements for establishing state residency to avoid complications.

Consulting Professionals

Given the complexity and variety in state tax laws, consulting with tax professionals can provide tailored advice that aligns with your financial situation and retirement goals.

Financial Advisors

Financial advisors can offer a comprehensive view of how different tax scenarios affect your overall retirement plan, guiding you in making informed decisions.

Tax Consultants and CPAs

Tax consultants and CPAs can help navigate specific state tax codes and identify opportunities for credits and deductions.

This image is property of www.kitces.com.

Conclusion

While the beauty of a location and proximity to family may heavily influence your retirement destination, understanding the tax implications should be a significant part of your decision-making process. Balancing these factors will help you achieve a financially secure and fulfilling retirement.

Happy planning, and may your retirement be everything you’ve dreamed of—and more!