Navigating the healthcare landscape as a retiree in the USA can be both daunting and crucial to ensuring you receive the care and support you need in your golden years. This comprehensive guide breaks down the various healthcare options available to you, from traditional Medicare and its various parts to supplemental plans and private insurance. We’ll explore the benefits and drawbacks of each option, helping you make informed decisions for your health and peace of mind. Discover how to optimize your healthcare coverage and maintain your well-being while enjoying your retirement to the fullest. Have you been wondering what your healthcare options will be once you retire in the USA? Navigating the healthcare system can be daunting, especially when you’re transitioning into retirement and trying to understand all the available options. So, let’s dive deep into this topic to find out what the best healthcare options can be for you during your golden years.

Check out our recommended retirement gifts!

Understanding Medicare

What is Medicare?

Medicare is a federal health insurance program primarily for individuals aged 65 and older, although younger people with certain disabilities can also be eligible. It’s the cornerstone of healthcare for retirees in the USA.

Parts of Medicare

Medicare is divided into several parts, each covering different services:

| Medicare Part | Coverage | Description |

|---|---|---|

| Part A | Hospital Insurance | Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. |

| Part B | Medical Insurance | Covers certain doctors’ services, outpatient care, medical supplies, and preventive services. |

| Part C | Medicare Advantage Plans | A type of Medicare health plan offered by private companies that contract with Medicare. Combines Part A, Part B, and usually Part D. |

| Part D | Prescription Drug Coverage | Adds prescription drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private-Fee-for-Service Plans, and Medicare Medical Savings Account Plans. |

Eligibility and Enrollment

If you’ve worked at least 10 years (40 quarters) in the USA and paid Medicare taxes, you generally qualify for premium-free Part A. Enrollment typically begins three months before your 65th birthday and continues for seven months. Missing this window could result in penalties.

Costs Associated with Medicare

Even though Part A might be premium-free, you are still responsible for deductibles and coinsurance. Part B usually comes with a monthly premium, and there are additional costs for Part C and Part D, depending on the plan you choose.

Medigap or Supplemental Insurance

What Is Medigap?

Medigap (Medicare Supplement Insurance) helps fill “gaps” in Original Medicare and is sold by private companies. It can help pay some of the healthcare costs that Original Medicare doesn’t cover, such as copayments, coinsurance, and deductibles.

Standard Medigap Plans

There are ten standardized Medigap plans available in most states, named Plan A, B, C, D, F, G, K, L, M, and N. Each plan has a different set of benefits, but they’re standardized across all insurance providers.

Costs and Considerations

Medigap policies generally have higher premiums but lower out-of-pocket costs when you need care. It’s essential to compare different plans and consider factors such as premium costs, benefits, and your health care needs.

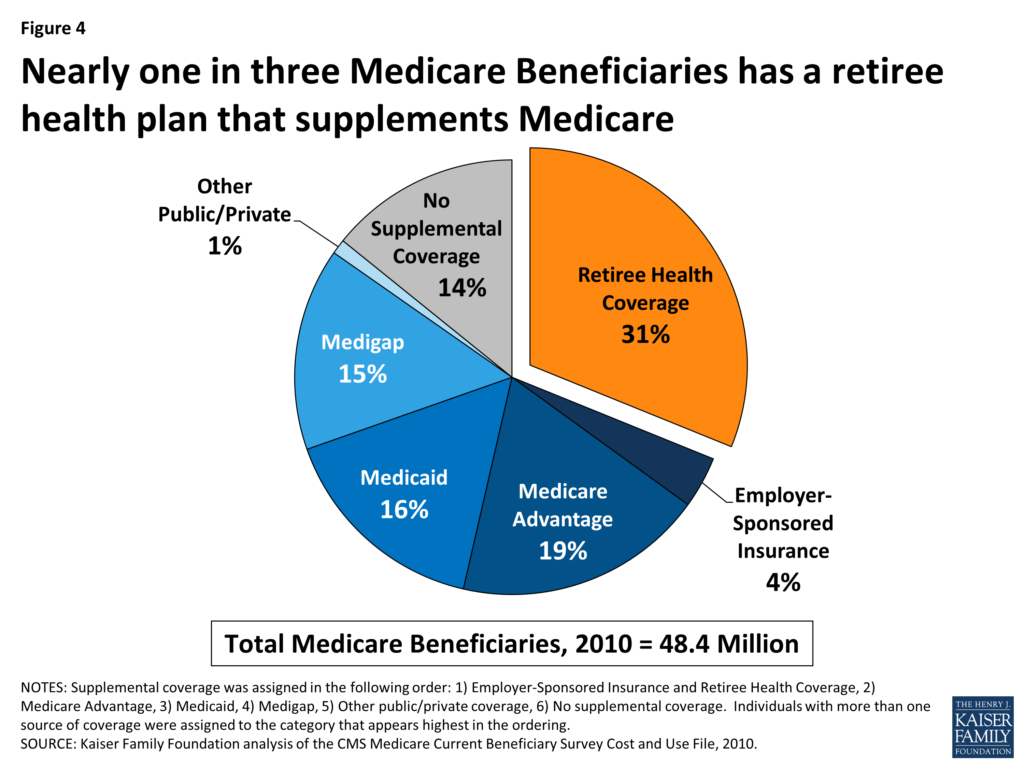

This image is property of www.kff.org.

Check out our recommended retirement gifts!

Medicare Advantage Plans (Part C)

What Are Medicare Advantage Plans?

Medicare Advantage Plans are an all-in-one alternative to Original Medicare. Offered by private companies approved by Medicare, these plans include all benefits and services covered under Part A and Part B and usually include Part D as well.

Types of Medicare Advantage Plans

| Plan Type | Description |

|---|---|

| Health Maintenance Organization (HMO) | Requires you to use doctors and hospitals within its network and get a referral to see specialists. |

| Preferred Provider Organization (PPO) | Offers more flexibility in choosing doctors and hospitals. You can use out-of-network services at a higher cost. |

| Private Fee-for-Service (PFFS) | You can go to any doctor or hospital that accepts the plan’s payment terms. |

| Special Needs Plans (SNPs) | Designed for people with specific diseases or characteristics. |

| Medicare Medical Savings Account (MSA) | Combines a high-deductible insurance plan with a medical savings account. Medicare deposits money into your MSA, and you can use it to pay for healthcare services throughout the year. |

Pros and Cons

Medicare Advantage Plans often offer additional benefits like vision, hearing, dental, and wellness programs. However, they may come with network restrictions, and out-of-pocket costs can vary significantly.

Medicaid

What is Medicaid?

Medicaid is a joint federal and state program that helps with medical costs for people with limited income and resources. It offers benefits not normally covered by Medicare, like long-term care services and personal care services.

Eligibility Criteria

Eligibility requirements vary from state to state but generally include low income, limited assets, and specific medical needs. Some seniors qualify for both Medicare and Medicaid, known as “dual eligibles.”

Applying for Medicaid

You must apply through your state’s Medicaid office. The income and asset thresholds, as well as the services covered, can vary significantly between states.

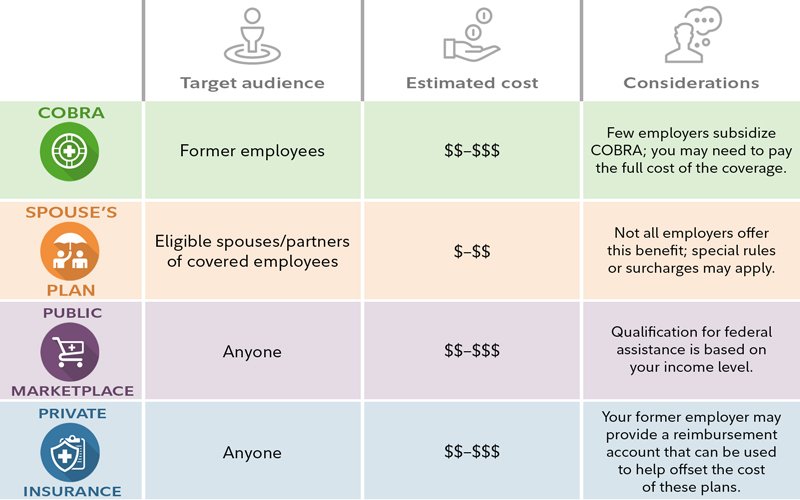

This image is property of www.verywellhealth.com.

Employer-Sponsored Retiree Insurance

What Is It?

Some employers offer retiree health benefits, providing supplemental coverage to retirees. These plans are becoming less common but can still be an excellent option if available.

Integration with Medicare

Employer-sponsored plans generally work as supplemental insurance, covering costs that Medicare doesn’t. Before dropping any employer-sponsored plan, check how it coordinates with Medicare and what costs you could incur without it.

Points To Consider

Find out if your employer plan includes prescription drug coverage (Part D). If it’s creditable coverage (as good as Medicare’s standard), you can avoid late enrollment penalties.

TRICARE and Veterans’ Benefits

What Is TRICARE?

TRICARE is the healthcare program for uniformed service members, retirees, and their families worldwide. If you’re a military retiree, TRICARE offers various plans to integrate with Medicare.

Veterans’ Benefits

Veterans Affairs (VA) healthcare is available to veterans meeting specific criteria. VA benefits can supplement Medicare but don’t replace it. Coordination between VA benefits and Medicare can be complex.

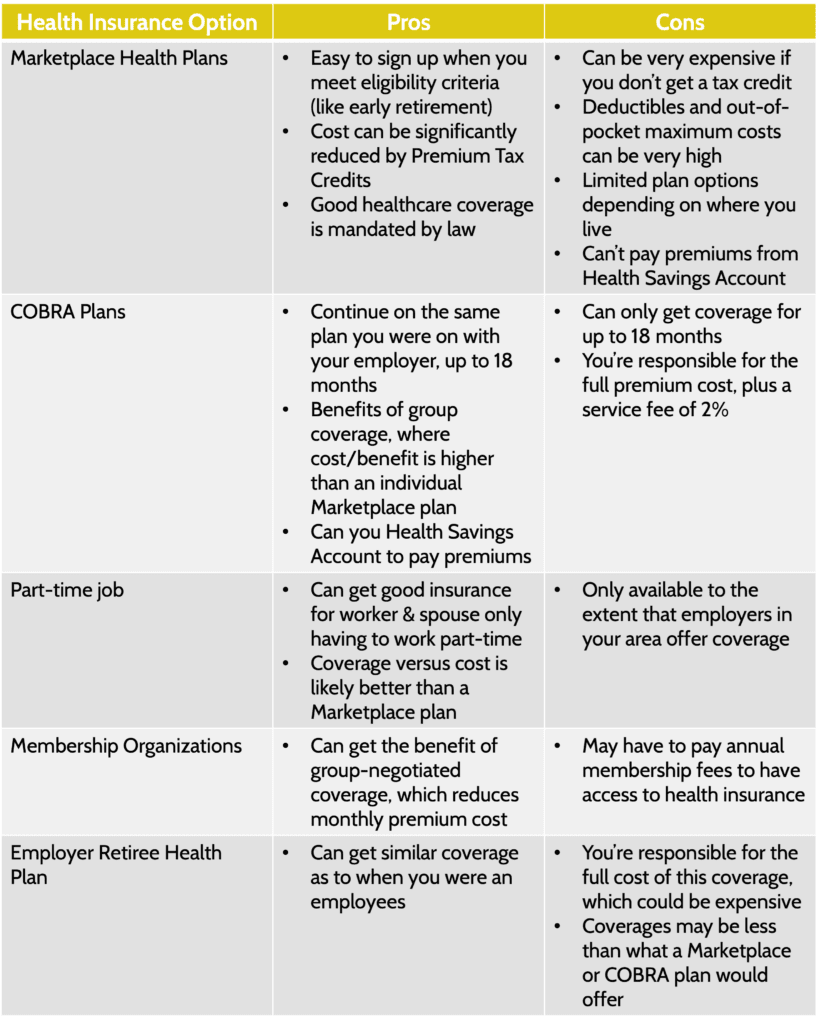

This image is property of www.fidelity.com.

Private Health Insurance

Marketplace Plans

If you’re retiring before age 65 and not yet eligible for Medicare, the Health Insurance Marketplace can be an option. These plans comply with the Affordable Care Act (ACA) and offer comprehensive coverage.

Short-Term Health Plans

Short-term health plans provide temporary coverage until you become eligible for Medicare. However, these plans don’t have to cover pre-existing conditions and often have limited benefits.

Considerations

The key is to find a plan that bridges the gap until Medicare eligibility. Compare premiums, out-of-pocket costs, network restrictions, and covered services to make an informed choice.

Long-Term Care Insurance

What Is Long-Term Care?

Long-term care includes services not covered by standard health insurance, Medicare, or Medicaid. This can range from assistance with daily activities to care in a nursing home.

Long-Term Care Insurance

Long-term care insurance can help cover the costs of these services. It’s best to buy long-term care insurance well before you need it, as premiums increase with age, and eligibility can be affected by existing health conditions.

Factors to Consider

Evaluate the policy’s coverage limits, premium costs, inflation protection, and the waiting period before benefits kick in. Consult with an insurance advisor to see if this is a good fit for your future needs.

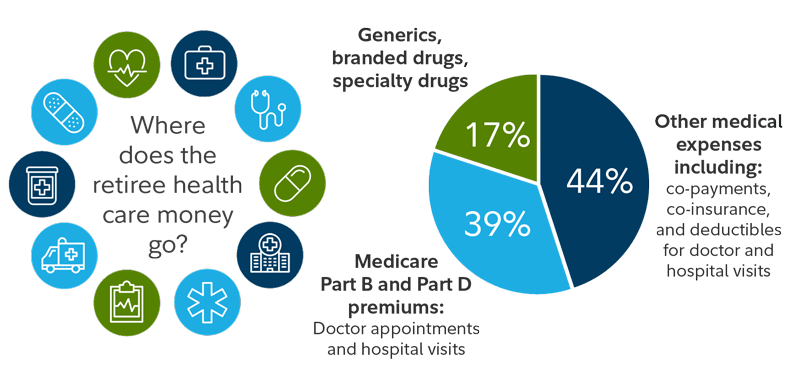

This image is property of financialdesignstudio.com.

Dental and Vision Care

Dental Insurance

Medicare doesn’t cover most dental care (including cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Many retirees opt for a separate dental insurance plan.

Vision Insurance

Similarly, Medicare doesn’t cover routine vision care, glasses, or contacts. Stand-alone vision insurance policies can cover these needs, and some Medicare Advantage plans may offer vision coverage as an additional benefit.

Options for Dental and Vision Care

Consider bundled packages that offer both dental and vision insurance or explore plans specifically designed to cater to retirees.

Prescription Drug Coverage (Part D)

Why It’s Important

Even if you currently take few or no medications, you should consider enrolling in a Part D plan to avoid late enrollment penalties.

Choosing a Part D Plan

Evaluate plans based on:

- The list of covered drugs (formulary)

- Monthly premiums

- Copayments or coinsurance

- Pharmacy network

Avoiding Penalties

Ensure you have creditable prescription drug coverage, whether it’s from a Medicare Part D plan or a comparable plan like some employer-sponsored retiree plans.

This image is property of www.fidelity.com.

Telehealth Services

Growing Popularity

Telehealth has seen significant growth, especially during the COVID-19 pandemic. Medicare now covers a variety of telehealth services, including doctor visits, counseling, preventive screenings, and more.

Benefits

Telehealth offers convenience, reduces the need for travel, and can be a safer option for those with mobility issues or weakened immune systems.

Considerations

Ensure your telehealth services provider accepts Medicare or your supplemental insurance plan. The costs and coverage can vary.

Preventive Services and Wellness Programs

Medicare and Preventive Services

Medicare covers many preventive services, from flu shots to yearly wellness visits, certain cancer screenings, cardiovascular screenings, and diabetes screenings.

Wellness Programs

Some Medicare Advantage Plans include access to wellness programs like SilverSneakers, which provides free gym memberships and fitness classes for seniors.

Importance of Preventive Care

Regular preventive care and engaging in wellness programs can help you maintain a healthier lifestyle and reduce overall healthcare costs.

Final Thoughts

Navigating healthcare options as a retiree in the USA can initially seem overwhelming, but understanding the basics of Medicare, supplemental insurance, Medicaid, employer-sponsored benefits, and other options will make it manageable. Take the time to evaluate your health needs, financial situation, and personal preferences to select the best healthcare plan for your retirement years. Remember, making informed decisions today will help ensure a healthier, happier tomorrow.

Are you ready to take control of your healthcare options and enjoy a worry-free retirement? It’s never too early to start planning and discussing your options with healthcare and financial advisors. Happy retirement planning!