In “How Can I Maximize My Retirement Income Through Investments?”, you’ll discover practical tips and insightful strategies to boost your financial security during your golden years. You will unravel the secrets behind selecting the right investment vehicles, diversifying your portfolio, and understanding market trends to ensure a steady and reliable income stream when you retire. This guide will empower you to make well-informed decisions, transforming your retirement planning into an exciting and rewarding journey. Have you ever thought about how you can maximize your retirement income through investments? The dream of a comfortable retirement is a common goal, yet many individuals find themselves uncertain about the best strategies to achieve it. Investing for retirement doesn’t have to be a daunting task, though. By understanding the various investment options and adopting a strategic approach, you can significantly enhance your financial security in your golden years.

Check out our recommended retirement gifts!

Why Investing Matters for Retirement

Most people rely on more than just social security or pensions to enjoy a financially secure retirement. Today, investing has become a crucial component of retirement planning. Not only does it help grow your savings, but it also provides the potential for higher returns compared to traditional savings accounts.

The Importance of Compound Interest

One of the most compelling reasons to invest is the power of compound interest. By reinvesting the earnings from your investments, you allow your money to generate even more earnings over time. This effect can substantially increase your retirement savings.

For example:

| Year | Initial Investment | Interest Earned | Total Amount |

|---|---|---|---|

| 1 | $10,000 | $500 | $10,500 |

| 2 | $10,500 | $525 | $11,025 |

| 3 | $11,025 | $551.25 | $11,576.25 |

| 10 | $15,940.90 | $797.05 | $16,737.95 |

Setting Retirement Goals

Before diving into specific investments, it’s important to have clear retirement goals. Ask yourself key questions that will shape your investment strategy.

How Much Will You Need?

Understanding how much you’ll need in retirement helps to set realistic savings and investment targets. Consider factors like your desired lifestyle, healthcare costs, and potential travel expenses.

What is Your Risk Tolerance?

Your risk tolerance will significantly influence your investment choices. Some people prefer the relative safety of bonds, while others are comfortable taking on the higher risks associated with stocks for the potential of greater returns.

Risk Tolerance Levels:

| Risk Tolerance | Investment Options |

|---|---|

| Low | Bonds, CDs, Money Market Accounts |

| Medium | Balanced Mutual Funds, Index Funds |

| High | Stocks, Cryptocurrencies, Real Estate |

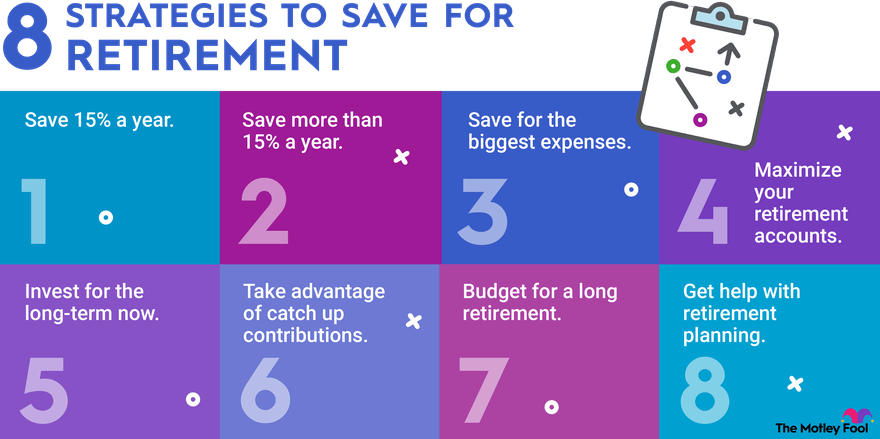

This image is property of m.foolcdn.com.

Check out our recommended retirement gifts!

Types of Retirement Accounts

Choosing the right retirement account can also significantly impact your retirement income. There are various retirement accounts available, each with its own benefits and limitations.

401(k) Plans

A 401(k) plan is a popular employer-sponsored retirement savings plan. Contributions are made pre-tax, which reduces your taxable income.

Traditional IRA

A Traditional Individual Retirement Account (IRA) also offers tax-deferred growth. Contributions might be tax-deductible, thereby reducing your taxable income in the year they are made.

Roth IRA

A Roth IRA allows for tax-free growth and tax-free withdrawals in retirement. Unlike a Traditional IRA, contributions are made with after-tax dollars.

Comparison of Retirement Accounts

| Account Type | Tax Treatment During Contribution | Tax Treatment During Withdrawal | Employer Match |

|---|---|---|---|

| 401(k) | Pre-tax | Taxable | Usually available |

| Traditional IRA | Possibly tax-deductible | Taxable | Not applicable |

| Roth IRA | After-tax | Tax-free | Not applicable |

Diversifying Your Investment Portfolio

Diversification is key to minimizing risks and maximizing returns. By spreading your investments across various asset classes, you can protect your portfolio against market volatility.

Asset Classes to Consider

- Stocks: Offer high returns but come with higher risk.

- Bonds: Provide steady income with lower risk.

- Real Estate: Offers potential for appreciation and rental income.

- Mutual Funds/ETFs: Provide diversification within a single investment.

- Cryptocurrencies: High-risk but potentially high-reward assets.

Creating a Balanced Portfolio

A balanced portfolio might include a mix of stocks, bonds, and alternative investments like real estate. The proportions will vary based on your risk tolerance and investment goals.

Example of a Balanced Portfolio:

| Asset Class | Percentage of Portfolio |

|---|---|

| Stocks | 60% |

| Bonds | 30% |

| Real Estate | 10% |

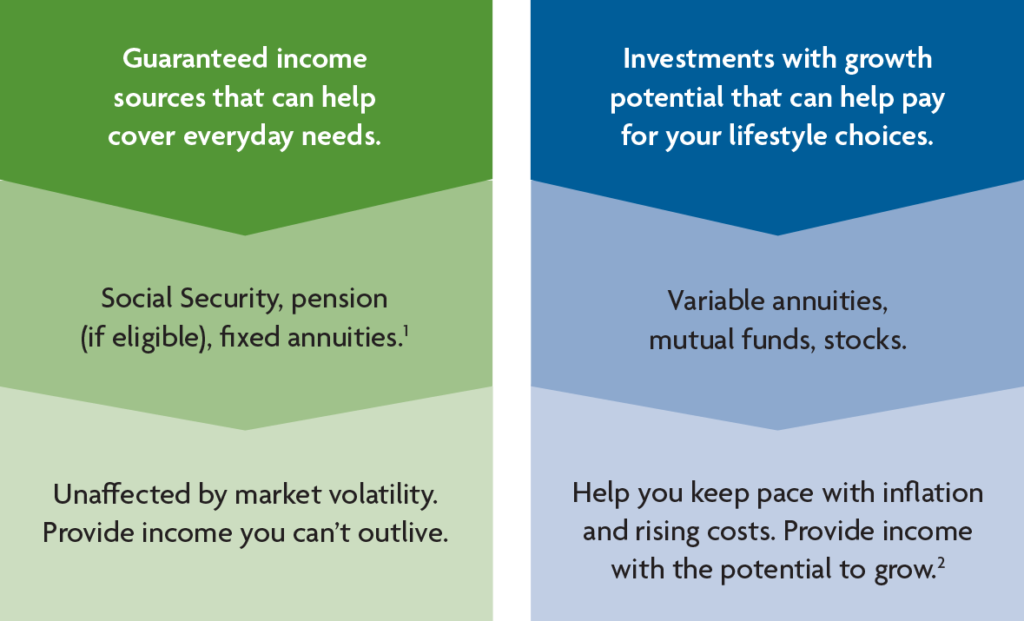

This image is property of www.tiaa.org.

Strategies for Maximizing Returns

Maximizing returns involves more than just selecting the right investments. It also requires strategic actions designed to take full advantage of market conditions and minimize costs.

Dollar-Cost Averaging

Dollar-cost averaging involves making regular, consistent investments over time, regardless of market conditions. This strategy reduces the impact of market volatility on your portfolio.

Rebalancing Your Portfolio

Periodic rebalancing ensures your investment mix remains aligned with your risk tolerance and financial goals. If one asset class performs particularly well, you may need to sell some of those assets and buy others to maintain your desired allocation.

Minimizing Fees

High management fees can erode your investment returns. Look for low-cost investment options like index funds or ETFs to keep fees in check.

Comparison of Investment Fees:

| Investment Type | Average Annual Fees |

|---|---|

| Actively Managed Funds | 1.00% – 2.00% |

| Index Funds | 0.05% – 0.25% |

| ETFs | 0.10% – 0.50% |

Managing Risk

While no investment is without risk, there are ways to mitigate these risks to secure your retirement income.

Diversification

As mentioned earlier, diversification is a primary way to manage risk. By not putting all your eggs in one basket, you can avoid losing everything if one investment underperforms.

Aligning Investments with Time Horizon

Your investment horizon will also affect your risk tolerance. If you have many years until retirement, you can afford to take more risks with high-growth investments. As retirement approaches, you may want to shift to more conservative investments to preserve your capital.

Consult a Financial Advisor

A financial advisor can provide personalized strategies tailored to your unique situation and goals. They can help you navigate complex investment environments and make informed decisions.

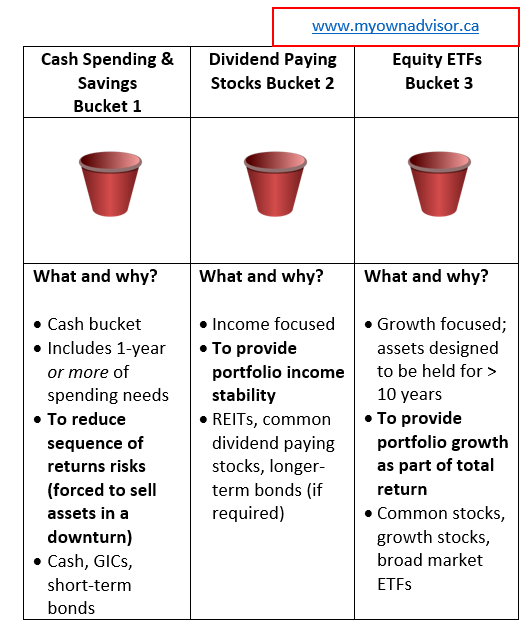

This image is property of fastercapital.com.

Monitoring and Adjusting Your Strategy

Once you have a strategy in place, continuous monitoring and adjustment are crucial for maximizing your retirement income.

Regular Portfolio Reviews

Review your portfolio at least annually to ensure it remains in line with your target allocation and financial goals. Significant life changes may also necessitate adjustments.

Staying Informed

Keep abreast of market conditions and economic indicators that could impact your investments. Staying informed allows you to make more timely and effective adjustments to your strategy.

Scenario Planning

Consider various retirement scenarios and how different investment outcomes could affect your financial security. Scenario planning helps you prepare for the unknown and adapt your strategy accordingly.

Tax-Efficient Strategies

Proper tax planning can also significantly enhance your retirement income. The goal is to minimize the amount of taxes you pay to maximize your net income.

Tax-Advantaged Accounts

Make full use of tax-advantaged retirement accounts like 401(k)s and IRAs. These accounts offer tax deferral or tax-free growth, which can help your investments compound more efficiently.

Tax-Loss Harvesting

Tax-loss harvesting involves selling losing investments to offset gains in other investments. This strategy can lower your tax liability and improve your after-tax returns.

Example of Tax-Loss Harvesting:

| Investment Type | Gains/Losses | Tax Implication |

|---|---|---|

| Investment A | +$5,000 | Capital Gains Tax Due |

| Investment B | -$3,000 | Reduces Taxable Gain |

| Net Taxable Gain | +$2,000 | Reduced Tax Liability |

Required Minimum Distributions (RMDs)

RMDs are mandatory withdrawals you must start taking from your retirement accounts at age 72. Failing to take RMDs can result in substantial penalties, so understanding these rules is crucial.

This image is property of i0.wp.com.

The Role of Social Security

While you shouldn’t rely solely on Social Security, it can be a valuable component of your retirement plan. Understanding how to maximize your Social Security benefits is essential.

When to Claim Social Security

The age at which you start claiming Social Security can significantly affect your benefits. Delaying benefits until age 70 can result in higher monthly payments compared to claiming at age 62.

Coordinating with Spousal Benefits

If you’re married, you may be eligible for spousal benefits, which can further enhance your retirement income. Coordinating when to claim your benefits and your spouse’s can maximize your combined benefit.

Passive Income Strategies

In addition to traditional investments, consider creating passive income streams to bolster your retirement income. Passive income requires minimal effort to maintain, providing regular cash flow.

Real Estate Investments

Owning rental properties can be a great source of passive income. While it requires some initial effort to manage, it can provide steady rental income and potential property appreciation.

Dividend Stocks

Investing in dividend-paying stocks offers regular income through dividends. Choose stocks from well-established companies with a history of stable dividend payments.

Peer-to-Peer Lending

Peer-to-peer lending platforms allow you to lend money directly to individuals or small businesses. In return, you receive interest payments, which can serve as a passive income source.

This image is property of www.investopedia.com.

The Impact of Inflation

Inflation can erode your purchasing power over time, making it essential to choose investments that outpace inflation. Historically, stocks and real estate have provided returns that exceed inflation rates.

Protecting Against Inflation

- Inflation-Protected Securities: Investments like Treasury Inflation-Protected Securities (TIPS) are designed to protect against inflation.

- Stocks: Historically, stocks have offered returns that outpace inflation over the long term.

- Real Estate: Property values and rental income often rise with inflation, providing a hedge.

Planning for Healthcare Costs

Healthcare is often one of the most significant expenses in retirement. Planning for and managing these costs is crucial for maintaining financial stability.

Health Savings Accounts (HSAs)

HSAs offer a tax-advantaged way to save for healthcare expenses. Contributions are tax-deductible, the account grows tax-free, and withdrawals used for qualified medical expenses are also tax-free.

Long-term Care Insurance

Long-term care insurance can help cover costs associated with extended care, whether at home or in a facility. This can protect your savings from being depleted by high healthcare costs.

Estate Planning

Effective estate planning ensures that your assets are distributed according to your wishes and can provide financial security for your loved ones.

Creating a Will

Having a will in place ensures your assets are distributed according to your wishes. It also simplifies the legal process for your heirs.

Trusts

Trusts can offer more control over how your assets are distributed and can also provide tax benefits. They are useful tools for complex financial situations or substantial estates.

Beneficiary Designations

Regularly review and update beneficiary designations on retirement accounts and life insurance policies to ensure they reflect your current wishes.

Continuous Learning

The world of investments is always evolving, so maintaining a commitment to continuous learning is essential. Read books, follow financial news, and consider taking courses on investment strategies.

Recommended Reading

Books like “The Intelligent Investor” by Benjamin Graham and “Rich Dad Poor Dad” by Robert Kiyosaki can provide valuable insights into effective investment strategies and financial planning.

Financial News Sources

Keeping up with reputable financial news sources like The Wall Street Journal, Bloomberg, and CNBC allows you to stay informed about market trends and economic developments.

Conclusion

Maximizing your retirement income through investments involves careful planning, ongoing management, and strategic decision-making. By setting clear retirement goals, diversifying your portfolio, and adopting tax-efficient strategies, you can build a robust financial foundation for your golden years. Remember, the key to successful retirement planning is to start early, stay informed, and be proactive in adjusting your strategies as needed. With the right approach, you can look forward to a comfortable and financially secure retirement.