Imagine spending your golden years without worrying about continued financial commitments. That’s what retirement is all about, right? But the question of paying Social Security after retirement often induces a sense of uncertainty. The article “Do I Pay Social Security After I Retire?” addresses this question, shedding light on the complexities related to Social Security payments post-retirement, clarifying your potential obligations, and guiding you along the path to a more secure retirement. It’s all about ensuring that you gain clarity and peace of mind as you embrace your well-deserved rest.

This image is property of www.investopedia.com.

Check out our recommended retirement gifts!

Understanding Social Security

What is Social Security?

Social Security is a federal program that provides financial support to eligible beneficiaries. These benefits are made available to individuals who are retirees, disabled, widows and widowers, and children of deceased workers. Social Security is designed to act as a safety net and provide you with a steady income once you retire or if you become disabled, ensuring you maintain a certain standard of living.

How is Social Security funded?

Social Security is primarily funded through payroll taxes, also known as the Federal Insurance Contributions Act (FICA). Employees contribute 6.2% of their earnings up to a cap, and employers match this amount. However, if you’re self-employed, you’re responsible for the full 12.4%. Any surplus from these Social Security taxes is invested in special-issue federal securities, creating a trust fund that can be used to cover any short-term revenue shortfalls.

Who is eligible for Social Security?

To be eligible for Social Security benefits, you need to earn sufficient credits over your working life. As of 2020, you would earn one credit for each $1,410 of earnings, up to a maximum of four credits per year. Most people need at least 40 credits (10 years of work) to qualify for retirement benefits.

Social Security and Retirement

How does retirement affect Social Security contribution?

Once you retire, you usually stop contributing to Social Security because those contributions are payroll-based and you’re no longer receiving that kind of income. However, if you continue to work part-time or open your own business, you may continue contributing to Social Security.

When to start claiming Social Security retirement benefits?

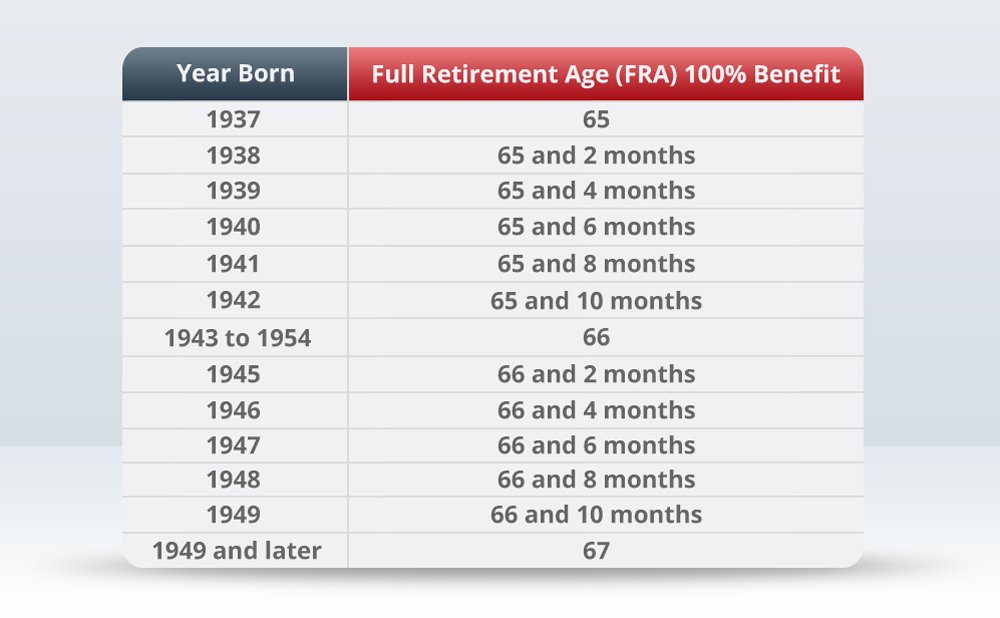

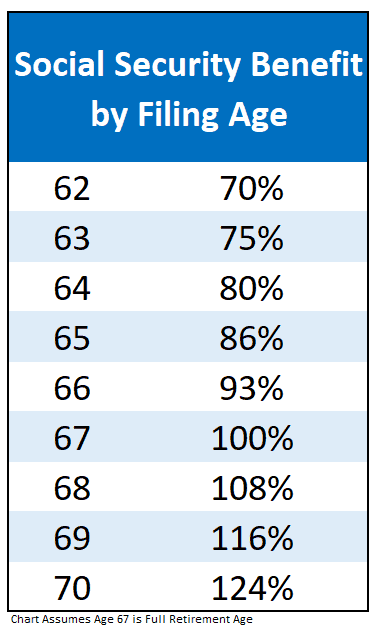

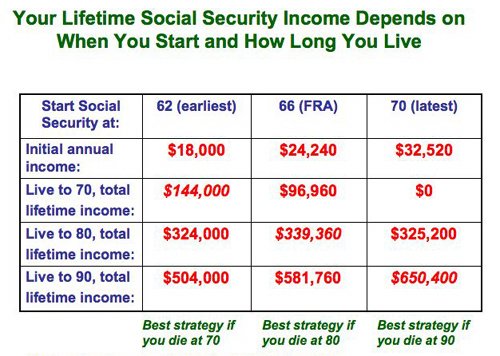

You can start receiving Social Security retirement benefits as early as 62, but your monthly benefits will be reduced. If you wait until your full retirement age (66 or 67, depending on when you were born), you’ll receive your full benefit. If you delay your benefits even further, your benefits will increase until you reach age 70.

Understanding Full Retirement Age

Your Full Retirement Age (FRA), determined by your birth year, is when you’re eligible to receive 100% of your social security benefits. For those born between 1943 and 1954, the FRA is 66. It gradually increases for those born after 1954, reaching 67 for those born in 1960 or later.

Check out our recommended retirement gifts!

Social Security Taxes after Retirement

Do I have to pay Social Security taxes after retirement?

Whether or not you have to pay Social Security taxes after retirement depends on your specific circumstances. If you continue to work, whether self-employed or as an employee, you will have to continue paying Social Security taxes on your earnings.

What is the retirement earnings test?

The retirement earnings test applies if you start receiving benefits before reaching your FRA and continue to work. Your benefits may be reduced depending on how much you earn. Once you reach your FRA, you can earn unlimited income without your benefits being reduced.

How do Social Security taxes on income work after retirement?

If you continue to work after retirement, all of your income regardless of the source is subject to Social Security tax up to the annual maximum. However, only the income you earn from working would cause your Social Security benefits to be taxed or reduced.

Social Security Benefits and Taxes

Is my Social Security benefit taxable?

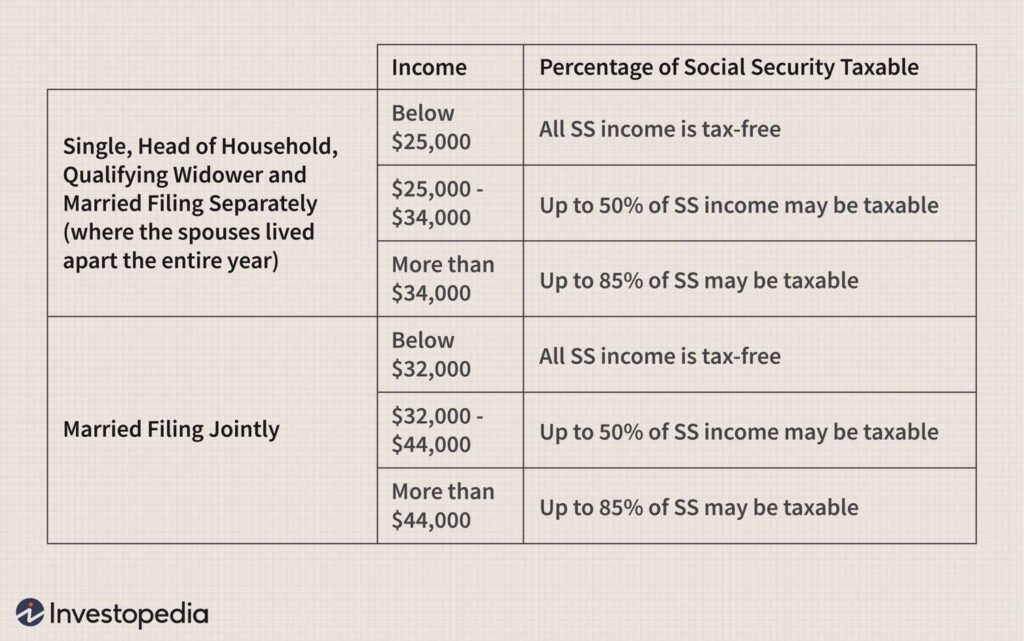

Whether or not your Social Security benefit is taxable depends on your total income and marital status. Specifically, if you have substantial income from other sources (wages, self-employment, interest, dividends, etc.), a portion of your benefits may be taxable.

When are Social Security benefits tax-free?

Your Social Security benefits could be tax-free if they’re your only source of retirement income, or if your total income falls below certain IRS thresholds.

Social security taxation rates after retirement

Between 50% and 85% of your Social Security benefits can be taxable. If you’re a single filer and your combined income is between $25,000 and $34,000, up to 50% of your benefits may be taxable. Any amount over $34,000 could be taxed up to 85%.

This image is property of www.londoneligibility.com.

Combined Income and Social Security Taxes

What is combined income?

Combined income is your adjusted gross income, not counting Social Security benefits, plus nontaxable interest and half of your Social Security benefits. This is the number used by the IRS to determine if your benefits are taxable.

How does combined income affect Social Security taxes?

Your combined income impacts the portion of your Social Security benefits subject to taxes. If your countable income exceeds a certain threshold, a portion of your social security benefits may be taxable.

Reducing taxes on Social Security benefits using combined income

To reduce taxes on your Social Security benefits, you’d need to reduce your combined income. This might involve shifting income to tax-free investments, or carefully planning withdrawals from retirement accounts to stay below the income thresholds for tax on Social Security benefits.

Rules for Pension Holders

Paying Social Security taxes while receiving pension

It’s possible you may have to pay taxes on both your Social Security benefits and your pension, depending on your total income.

Implications on Social Security due to Pension

If you receive a pension from a job where you didn’t pay Social Security taxes, it could reduce your Social Security benefits.

Public-sector pensions and Social Security taxes

For those receiving a public-sector pension (like government workers), you may be subject to the Windfall Elimination Provision, which can reduce your Social Security retirement benefits.

This image is property of assets-global.website-files.com.

How Working in Retirement Impacts Social Security Taxes

Earnings limit for retired workers

If you retire before your full retirement age and continue to work while receiving Social Security benefits, there’s an earnings limit. In 2020, the limit was $18,240.

Impact on Social Security benefits due to continued income

Continued income after retirement could result in reduced Social Security benefits if you haven’t reached full retirement age. However, once you reach full retirement age, there’s no limit to how much you can earn while collecting Social Security.

Implications on Social Security taxes for self-employed retirees

Self-employed retirees are still required to pay Social Security and Medicare taxes on their earnings, even if they’re already collecting benefits.

Social Security and Non-Taxable Income

Types of non-taxable income

Non-taxable income can include certain types of life insurance benefits, child support payments, welfare benefits, workers’ compensation benefits, gifts, bequests, and certain types of combat pay.

Influence of non-taxable income on Social Security taxes

Non-taxable income doesn’t contribute to your combined income calculation for Social Security taxes, but it can impact how your Social Security benefits are taxed.

Managing non-taxable income in retirement

You can manage non-taxable income to reduce your combined income, avoiding or reducing taxes on your Social Security benefits.

This image is property of www.lifeplanningtoday.com.

Managing Social Security Taxes After Retirement

Strategies to reduce or avoid Social Security taxes

Several strategies can help you reduce or even avoid Social Security taxes, from managing your income sources to reduce your combined income, to delaying benefits until full retirement age, or even moving to a state that doesn’t tax Social Security benefits.

Role of financial planning in managing Social Security taxes

Financial planning can play a significant role in managing Social Security taxes. A well-constructed financial plan can ensure you strategize your income and withdrawals to minimize taxes.

Implications of tax efficient retirement withdrawals

Tax-efficient withdrawal strategies can help to preserve your retirement savings and potentially reduce the taxation of your Social Security benefits.

Seeking Professional Advice

Who can help manage Social Security taxes?

A financial advisor, tax professional or an accountant can help you make sense of Social Security tax rules, ensuring you keep as much of your benefits as possible.

Benefits of professional financial advice regarding Social Security taxes

Professional financial advice can help in planning your income strategy, navigating Social Security tax laws, and incorporating your Social Security benefits into your retirement planning.

Finding a reliable financial advisor

When looking for a financial advisor, consider their expertise in Social Security strategies, credentials, fee model, and availability. It’s critical to find someone who understands your financial situation and can help you minimize the taxes you pay on your Social Security benefits.