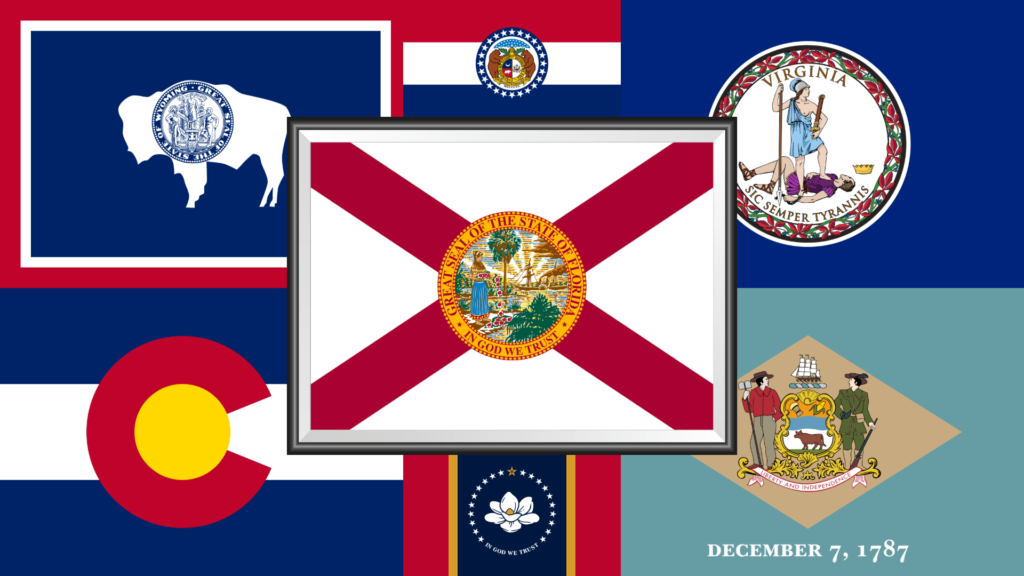

In the quest to pinpoint the best states to retire, considerations such as affordability, quality of healthcare, and safety are pivotal. The United States brims with retirement-friendly locales, each with unique advantages and potential downsides. Whether it’s the peaceful coastal sunsets of Florida, Colorado’s mountain autumnal splendor, or Virginia’s historic allure, the journey to retirement is about more than a place—it’s about finding a home where one can flourish and savor the rewards of years of hard work.

Our comprehensive guide is designed to reveal the top 5 states to retire, distinguished by their exceptional qualities for retirees. We traverse from Florida’s sandy shores to Colorado’s towering peaks, exploring what makes each state a potential retirement haven. Factors like favorable tax rates, health care accessibility, affordability, and the happiness of residents are thoroughly examined, offering a well-rounded view of each destination. Whether drawn to California’s endless sunshine, Pennsylvania’s deep-rooted history, Arizona’s breathtaking landscapes, or Massachusetts’ cultural richness, our guide aims to assist in making a well-informed, bespoke retirement choice.

Florida

Florida emerges as a premier choice for retirement paradise, and it’s not hard to understand its appeal. Let’s explore the details that position the Sunshine State as a top destination for retirees making it one of the best states to retire in:

- Warm Climate and Low Taxes: The allure of Florida’s year-round warm climate is a major attraction for retirees seeking sun-filled days and gentle winters. Additionally, the state’s tax policies are notably favorable for retirees, with no state income tax on Social Security benefits or pension incomes, enhancing affordability and enabling a more relaxed retirement budget. The combination of no state income tax and a cost of living below the national average solidifies Florida’s status as an enticing option for retirement living. best state to retire in 2024.

- Retirement Plans through the Florida Retirement System (FRS): The FRS provides two primary retirement plans for its members: Additionally, the FRS offers the Deferred Retirement Option Program (DROP) Retirement accounts play a crucial role in financial planning, offering a way for members to grow their retirement benefits in an interest-bearing account while they continue to earn an income.

- Investment Plan: This type of plan is a cornerstone of retirement savings, where the benefits hinge on the contributions made and the performance of the selected investment funds, providing flexibility through a range of investment choices.

- Pension Plan: As a defined benefit plan, the FRS Pension Plan is a key retirement income source that calculates benefits based on a formula that accounts for service duration, average final compensation, and the chosen retirement option. Vesting in this plan requires a specific period of creditable service, and it also includes a cost of living adjustment (COLA), which is vital for maintaining the purchasing power of retirees, reflecting a commitment to the quality of healthcare and financial stability in retirement.

Support and Resources for Retirees and Employers:

- For those entering their golden years, the FRS stands as a beacon of support, offering a wealth of health care resources and retirement savings guidance. Among these are a detailed retirement checklist, the Guided Choice Advisor Service, a health insurance subsidy, and options for lifetime income. The Health Insurance Subsidy (HIS) provides a monthly payment of up to $225 to retirees with eligible health insurance, reflecting their years of dedicated service.

- New employees are greeted with a suite of orientation materials, including an informative brochure, a detailed benefit comparison statement, and foundational Retirement 101 resources. They are tasked with the important decision of selecting their retirement plan within the first 90 days of employment, an action that can be aided by using a retirement calculator.

- Employers are empowered with a comprehensive array of reference materials, tools, and services designed to assist in their pivotal role within the FRS. This support extends to educational workshops and informative newsletters, all integral to effective financial planning for the workforce.

The fusion of financial benefits, exceptional quality of healthcare, and a wealth of supportive resources positions Florida as a leading destination for retirees. Its top-tier geriatrics hospitals address healthcare needs with finesse, while diverse retirement plans lay the groundwork for achieving financial goals. Florida’s commitment to nurturing a supportive environment for retirees and employers alike shines through, solidifying its status as a top retirement choice. best states to retire.

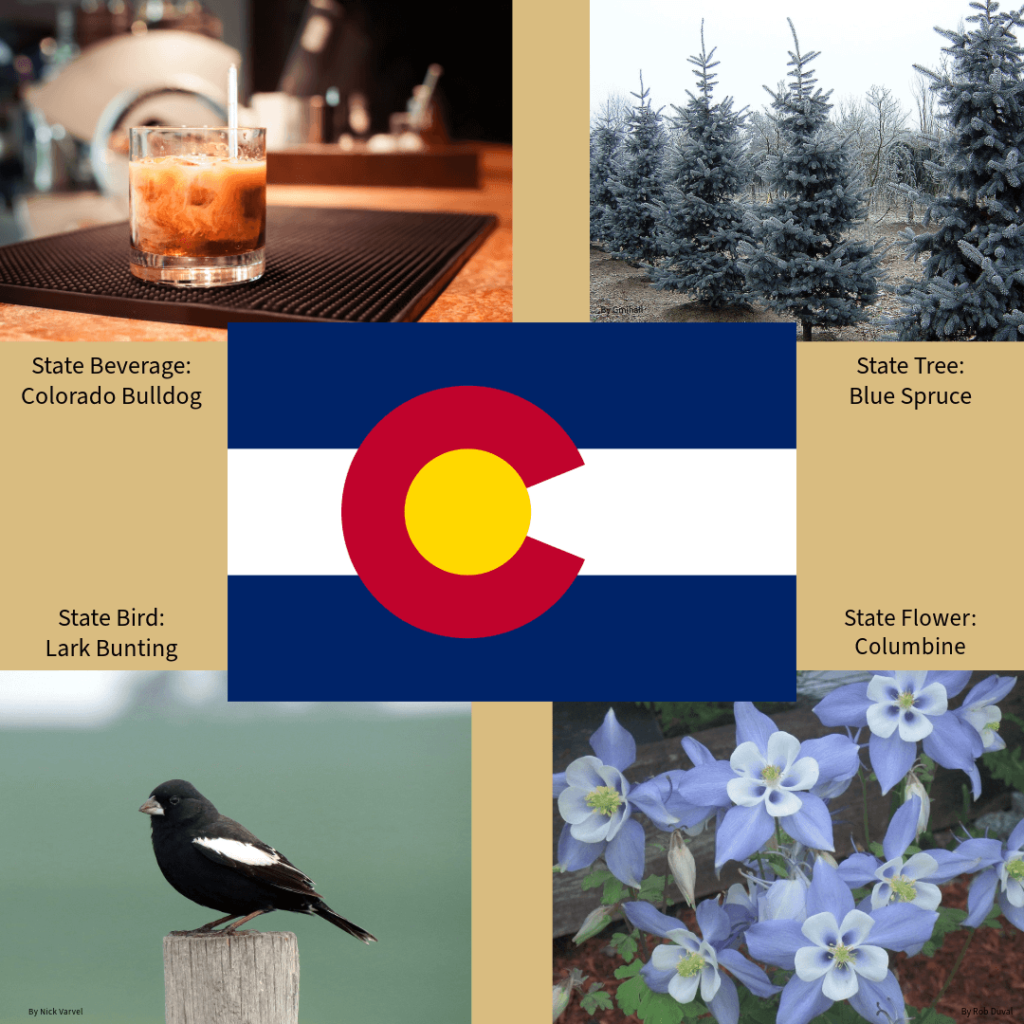

Colorado

Colorado’s allure as one of the best states for retirement is multi-dimensional, appealing to those in search of natural splendor, cultural richness, and an active lifestyle. When considering relocation, it’s crucial to balance the state’s many benefits with any possible drawbacks, keeping in mind the quality of healthcare and opportunities for an active retirement.

- Natural Beauty and Recreation: The varied terrain of Colorado presents retirees with an unmatched setting for outdoor pursuits. With its four distinct seasons, the state invites retirees to partake in skiing, hiking, and biking, among a plethora of activities. Thanks to the state’s temperate climate, these activities can be enjoyed throughout the year, particularly in cities like Grand Junction and Boulder, which frequently feature on lists of top retirement states. best places to retire in Colorado due to their access to nature and recreational opportunities.

- Healthcare and Wellness: Colorado takes pride in its healthcare offerings, with a roster of world-class hospitals and medical facilities at the ready. This extensive network ensures that retirees receive quality medical care, supporting their health and wellness as they embrace Colorado’s active lifestyle ethos. fantastic healthcare options align with the priorities of many retirees.

- Tax Benefits and Retirement Communities: Colorado, often regarded as the best state for retirement, provides financial incentives that are particularly appealing to retirees. The state boasts attractive tax rates, with no tax on Social Security benefits, and offers a property tax homestead exemption for residents aged 65 or older. Retirement communities across Colorado present a range of living arrangements, from independent living to more supportive environments, addressing the varied housing costs and preferences of retirees. retirement communities, contribute to Colorado’s status as a desirable retirement destination.

Despite these attractions, retirees should be aware of a few considerations:

- Cost of Living: While the cost of living in Colorado typically exceeds the national average, it’s important to note that housing costs and healthcare expenses are significant contributors to this. Housing costs, in particular, can differ widely, with areas like Estes Park and Vail being notably pricier. Those considering retirement should thoroughly investigate the cost of living in various Colorado towns and cities to ensure alignment with their financial plans.

- Urban Challenges: Colorado’s major urban centers, such as Denver and Colorado Springs, are infamous for their heavy traffic, which may discourage some retirees. Moreover, the state’s vulnerability to natural disasters, including wildfires and floods, is an important consideration, as these events can affect crime rates and overall quality of life.

In conclusion, Colorado presents a strong argument as the best state to retire, thanks to its breathtaking mountains landscapes, abundant active lifestyle choices, and high quality of healthcare. Nevertheless, retirees must weigh their budget and lifestyle preferences against the state’s elevated cost of living and the challenges presented by urban areas. With careful planning, retirees can discover their perfect retirement haven in the Centennial State.

Virginia

Virginia stands out as a prime retirement spot, celebrated for its rich history, diverse culture, and extensive living options for retirees. If you’re considering Virginia for your retirement, here’s an essential guide to understanding the retirement living costs in the Old Dominion:

Independent and Assisted Living Costs:

- Independent living in Virginia offers affordability and independence, with monthly costs ranging from about $1,400 to $4,000, depending on the location and amenities offered.

- Assisted living facilities in Virginia provide retirees with more hands-on care and support, reflecting the state’s commitment to quality healthcare. The average monthly housing costs for these facilities are a critical factor to consider when planning for retirement. $4,850 The affordability of assisted living in Virginia can vary, with the cost above the national average. However, retirees will find that some areas within the state offer average yearly prices that are up to $14,460 less than the state average, presenting opportunities for cost-effective retirement planning.

Specialized Care Options:

- In Virginia, individuals requiring specialized memory care, including those with Alzheimer’s disease and dementia, can expect a high quality of healthcare with costs typically ranging from $3,000 to $7,000 monthly.

- Skilled nursing facilities provide comprehensive 24-hour supervised care, with average costs of $7,441 for a semi-private room and $8,365 for a private room each month.

Financial Assistance and Cost Projections:

- Though Medicaid in Virginia does not cover assisted living costs directly, financial assistance is accessible through the STAR+PLUS waiver, aiding eligible seniors with these expenses.

- To support the financial planning for retirement living, programs such as the Veterans Aid & Attendance Benefit and Long-Term Care Insurance are available to help seniors bolster their retirement savings and manage costs effectively.

- It’s crucial to consider that the cost of independent living is not immune to inflation, with projections indicating a rise in the average cost of living for retirees. $3,417 per month by 2024.

When making financial decisions about retirement in Virginia, it’s essential to consider the state’s retirement-friendly financial landscape, which can significantly impact your quality of life.

Retirement Community Costs and Living Options:

- The Virginia housing market offers a spectrum of retirement community living options, from more affordable homes starting in the mid $100ks to luxurious properties surpassing $1 million, such as those found at Atlantic Shores in Virginia Beach. flexible payment options to suit different preferences and budgets, including Signature, Charter, and Founding Memberships.

- It’s important to weigh personal factors when choosing a retirement community, considering that while some may have age restrictions, others offer a more inclusive environment, fostering a diverse community experience.

Economic Considerations for Seniors:

- Virginia’s senior citizens enjoy a higher life expectancy and median household income compared to the national average, with a significant number of seniors actively participating in the labor force.

- In Virginia, the state’s overall cost of living is above the national average, making it crucial to balance the expenses of retirement community living with the availability of financial assistance and resources for seniors.

As we delve into the best states for retirees, Virginia’s diverse options and the essential financial planning considerations play a pivotal role in determining if it’s the ideal choice for your retirement plans.

Delaware

Delaware, affectionately known as The Diamond State, is celebrated as a top choice among retiree-friendly states, shining as one of the best places to retire due to a blend of factors that promote a peaceful retirement lifestyle. Here’s what makes Delaware an attractive destination for retirees, including favorable tax rates:

Tax Benefits:

- Delaware’s tax policies stand out as particularly favorable for retirees, with the state boasting no sales tax, which translates into substantial savings on everyday purchases.

- Property taxes are notably low, easing the financial burden on homeowners.

- For residents over 65, Delaware enhances affordability by offering additional tax deductions, which serves to further reduce the cost of living for retirees.

- Importantly, in Delaware, retirement income sources such as Social Security benefits are not subject to state taxes, allowing retirees to retain more of their hard-earned money.

Outdoor Activities and Community Life:

- The state boasts an active lifestyle paradise, with 28 miles of scenic beaches, 17 state parks, and an abundance of hiking trails, water sports, and golf courses, catering to outdoor enthusiasts.

- Delaware’s historical demonstrations provide a window into the state’s cultural heritage, celebrating its status as the first to ratify the U.S. Constitution.

- Quaint communities like Lewes, a walkable city, radiate small-town charm and offer a vibrant cultural scene with museums, boutiques, and contemporary amenities, alongside diverse dining options, epitomizing the essence of modern living.

Strategic Location and Housing:

- Delaware’s strategic mid-Atlantic location is perfect for those considering relocation, offering tranquil living with seamless access to urban amenities in major cities like Philadelphia, New York City, and Washington, D.C.

- The state presents affordable housing opportunities and boasts lower property taxes compared to its neighbors like New Jersey and Maryland, making it an attractive option for homebuyers.

- Highlighted in a WalletHub study as the second best state to retire, Delaware shines for its affordability, citizen well-being, and favorable weather conditions.

While Delaware grapples with healthcare costs that are marginally above the national average, its healthcare quality and advantageous tax policies are commendable, placing it 17th for healthcare access. These factors, including no income tax on retirement income and a significant number of health-related establishments per capita, solidify Delaware’s reputation as a top retirement destination for 2024.

Wyoming

Embarking on a quest for the best places to retire, Wyoming emerges as a prime destination with its vast landscapes and tax-friendly environment. Let’s delve into why the Equality State could be the ideal locale for your golden years:

Tax Advantages:

- Wyoming shines in the realm of tax rates, offering retirees the advantage of no state income tax. This means your retirement income sources, from Social Security benefits to 401(k) withdrawals and pension income, are free from state tax, allowing you to maximize your retirement savings.

- Property taxes in Wyoming are remarkably low, with homeowners enjoying the 10th-lowest average effective rate in the nation at just 0.60%. This equates to an approximate $600 annual cost per $100,000 of home value, providing significant savings for property owners.

- When considering sales tax, Wyoming presents an appealing picture with a modest state rate of 4% and an average total rate of 5.36% once local taxes are accounted for. The exemption of essentials like groceries, prescription medications, and medical supplies from sales tax further alleviates the financial burden for retirees.

Cost of Living and Housing:

- The cost of living in Wyoming sits slightly below the national average, potentially enabling some retirees to sustain themselves on Social Security alone, especially in the state’s more economical regions.

- Wyoming’s housing market is diverse, with a median home value of approximately $323,197, offering a variety of residential choices. It’s important to note, however, that locales such as Teton County boast much higher median home values, a testament to the allure and scenic splendor of areas adjacent to national parks.

Healthcare and Quality of Life:

- Wyoming’s reputation for healthcare quality, coupled with its favorable tax policies, ranks it among the top states for retirement living. The state’s dedication to healthcare is evident in the ample availability of health-related facilities for its residents.

- Wyoming’s absence of an estate tax ensures that your legacy can be seamlessly transferred to your loved ones, free from additional state-level estate tax burdens.

When considering Wyoming as a retirement destination, it’s crucial to balance these financial advantages with your lifestyle preferences and personal needs. The state’s low fuel taxes, including reduced excise taxes on alcohol, cigarettes, and gasoline, amplify its allure for those in search of a retiree-friendly environment. Wyoming, with its expansive open spaces and a more relaxed pace, could be the perfect haven you envision for your retirement years.

Conclusion

This guide’s thorough exploration and unbiased analyses have identified the best retirement states in the United States, taking into account essential factors like cost of living, healthcare systems, tax incentives, and overall quality of life. States such as Florida, Colorado, Virginia, Delaware, and Wyoming stand out as premier destinations for retirees, each presenting its own charm through climate, culture, and financial advantages that enhance the quality of life during the post-career stage.

As you stand on the cusp of retirement, let the insights from this comprehensive guide illuminate your path to a decision that ensures fulfillment and tranquility in your golden years. Consider a retirement move that aligns with your aspirations, and begin the final preparations for a treasured new chapter. discover the best retreat Consider a trial run for your individual journey into retirement, where new adventures beckon and peace of mind is of utmost importance. What’s your retirement age?

FAQs

What is the premier state for retirement in the United States?

Iowa is heralded as the best state to retire on a fixed income, offering an affordable cost of living, cost-effective housing options, and a strong economy—all factors that help extend the reach of retirement savings.

Which state is the most financially advantageous for retirees?

South Carolina stands out as the best state for retirement for those aiming to optimize their financial resources. It’s celebrated for its agreeable climate, low cost of living, and burgeoning retiree community. With fundamental expenses like groceries and transportation approximately 4.7% lower than the national average, South Carolina presents an attractive proposition for economical living in retirement.

Which locale ranks as the best retirement destination in the United States?

A recent study by U.S. News and World Report has crowned Harrisburg, Pennsylvania, as the best place to retire in the U.S. for the year 2024. This accolade highlights Harrisburg’s appeal to those seeking a fulfilling post-career life.

In which city do retirees find the greatest happiness?

Leading the way in retiree satisfaction, Barnstable, Massachusetts, has been recognized as one of the happiest cities for retirement, according to a comprehensive study of 200 cities focusing on overall community well-being. Notably, Barnstable boasts a significant demographic of residents aged 65 and above, with Naples, Florida, and Ann Arbor, Michigan, also ranking high for retiree happiness.

Additional States to consider retiring in: Missouri and Mississippi

When it comes to retirement, finding the perfect place to settle down is a highly personal choice, influenced by factors such as climate, cost of living, community, and accessibility to healthcare. While states like Florida and Arizona typically steal the retirement spotlight, there are lesser-celebrated gems that deserve consideration. Let’s explore two such states that might not be at the top of everyone’s list but offer unique benefits for retirees: Missouri and Mississippi.

Missouri: The Show-Me State’s Show-Stopping Appeal

Missouri might not be the first state that comes to mind for retirement, but it has a surprising number of offerings that could make it an ideal location for your golden years.

Affordable Living

- Cost of Living: One of Missouri’s most attractive features is its affordability. The overall cost of living in Missouri is below the national average, which means your retirement savings can stretch further here.

- Housing: Housing costs are also significantly lower than in many other states, making it possible to find a comfortable home without breaking the bank.

Healthcare Access

- Quality Healthcare: With several top-rated hospitals, including the Barnes-Jewish Hospital in St. Louis, retirees have access to excellent healthcare services.

Natural Beauty and Activities

- Outdoor Recreation: Missouri is home to beautiful natural parks, such as the Lake of the Ozarks and the Ozark National Scenic Riverways, offering ample opportunities for fishing, boating, hiking, and enjoying the great outdoors.

- Cultural Experiences: The state boasts a rich cultural scene, with attractions like the Saint Louis Art Museum, the National WWI Museum and Memorial in Kansas City, and a vibrant music scene in Branson.

Mississippi: The Hospitality State’s Warm Welcome for Retirees

Often overlooked, Mississippi has its own charm and a host of reasons why it might be the ideal retirement destination for some.

Low Cost of Living

- Budget-Friendly: Mississippi frequently ranks as one of the least expensive states in the U.S., from groceries to utility bills to transportation.

- Tax Advantages: The state is also tax-friendly for retirees, with no tax on Social Security income and exemptions for other forms of retirement income.

Mild Climate

- Warm Weather: Mississippi’s mild climate is a huge draw for those looking to escape the harsh winter weather of the north. The state enjoys long, warm summers and short, mild winters.

Southern Hospitality and Culture

- Community Feel: With its famous southern family hospitality, Mississippi offers a welcoming environment and a slower pace of life that can be quite appealing for retirees.

- Rich Heritage: The state is steeped in history and culture, with deep roots in music, literature, and the arts. Places like the Mississippi Blues Trail and the historic city of Natchez are just a few examples.

Healthcare

- Healthcare Services: Mississippi has several medical centers like the University of Mississippi Medical Center in Jackson, providing access to specialized healthcare services.

Conclusion

Both Missouri and Mississippi offer unique perks for retirees, from affordability to cultural richness. When considering where to retire, think beyond the conventional options and explore what these states have to offer. A lower cost of living, friendly communities, and access to healthcare and entertainment might just tip the scales in their favor. Before making any decisions, it’s always wise to visit and get a firsthand feel for the place you’re considering calling home. Happy retirement planning!

Thanks for reading! Hope this information helps you understand the age of retirement in the US and some of the advantage and disadvantage of retirement. Check out some of our other posts for more information here – Blog Posts