You’ve been saving, planning, and working your whole life and now retirement is on the horizon. Often, a question that comes up is whether or not you can draw Social Security at 62 yet continue to work full time. The answer is complex, navigates through several rules, conditions and nuances of the Social Security System itself. In the following article, you’ll find an in-depth exploration of this topic, offering clarity and understanding to this frequently asked question.

This image is property of i.ytimg.com.

Check out our recommended retirement gifts!

Understanding Social Security Eligibility

Understanding Social Security eligibility can seem daunting, but once you break it down, it becomes a lot easier to comprehend.

The age factor in eligibility

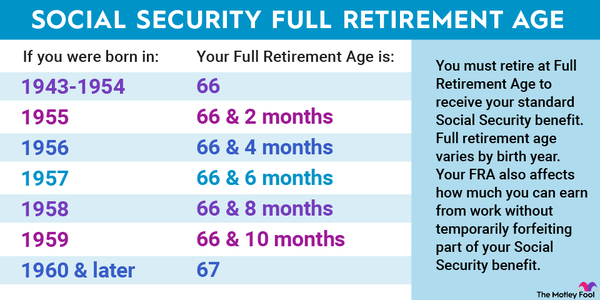

When it comes to social security, age plays a crucial role in determining your eligibility. Although the earliest age to start receiving social security retirement benefits is 62, your full retirement age depends on your birth year. It’s crucial to note that drawing early comes with drawbacks, including reduced monthly benefits.

Consideration of your work history

Your work history also plays a significant role in qualifying for Social Security benefits. In essence, to be eligible, you need to have worked and paid Social Security taxes for at least 10 years. The amount you’ll receive is primarily based on your 35 highest-earning years of work.

Current employment status impact

Your current employment status can impact your Social Security benefits, especially if you’re considering drawing benefits while still working. Various rules govern how much you can earn while drawing benefits, and exceeding these limits may result in a reduction in your benefits.

Early Retirement and Social Security

If you’re contemplating early retirement, it’s essential to understand how it can impact your Social Security benefits.

Effects of early retirement on Social Security benefits

If you choose to retire early and start drawing your benefits at 62, be aware that your monthly benefit will not be as high as if you wait until your full retirement age. This is designed to balance out the fact that you’ll be receiving benefits for a longer period.

The reduction factor for claiming benefits early

The reduction factor for early retirement can have a noticeable impact on your Social Security benefits. Essentially, for every year you claim before your full retirement age, your benefits will be reduced by a specific percentage. This reduction is a permanent adjustment to your Social Security income, so it’s something to consider very carefully.

Check out our recommended retirement gifts!

Working Full-Time While Drawing Social Security at 62

Whether it’s possible to work full-time at 62 while claiming Social Security

Yes, it’s possible to work full time while drawing Social Security at 62. However, if you haven’t reached your full retirement age, there are limits to how much you can earn without impacting your benefits.

The implications on your benefits

If you’re working full time and drawing Social Security, there can be implications for your benefits. Specifically, if you heartrending more than a certain amount, Social Security will temporarily reduce your benefits. However, once you reach your full retirement age, these reductions stop, and your benefit may increase to account for time when they were reduced.

The Earnings Test and its Application

How the Social Security earnings test works

The Social Security earnings test is a method used to determine if your work income is within acceptable limits while you’re receiving benefits before your full retirement age. If your income exceeds the earnings limit, your Social Security benefits will be reduced.

The earnings limit under the test

The earnings limit is a set amount that changes from year to year. For example, in 2021, the limit is $18,960 for individuals who have not reached full retirement age. If you earn more than this amount, your benefits will be reduced.

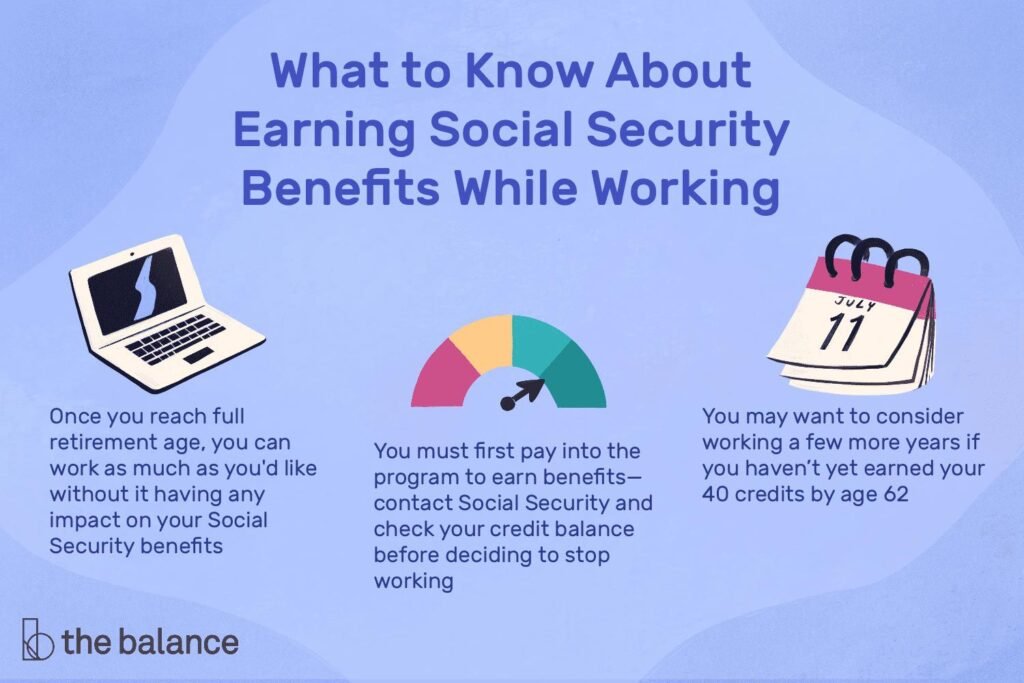

This image is property of www.thebalancemoney.com.

Impact of Exceeding the Earnings Limit

How Social Security adjusts your benefits when you exceed the limit

If your earnings exceed the limit set by the Social Security Administration, your benefits will be decreased. The exact amount of reduction depends on how far away from full retirement age you are.

Conditions under which the limit doesn’t apply

Once you reach your full retirement age, the earnings limit no longer applies. This means you can earn as much as you want without having your benefits reduced.

Consideration of Future Year Retirement

Taking into consideration future year retirement is important while making plans to retire early.

The possibility of higher benefits if you delay claiming

If you delay claiming your Social Security benefits, you can get a higher monthly benefit. For each year you delay taking benefits beyond your full retirement age up until age 70, your monthly benefits will increase by a certain percentage. This could significantly boost your income in later years.

Comparison between early claiming and delayed claiming

Comparing early claiming and delayed claiming is an excellent way to figure out which option is best for you. Early claiming will provide income sooner, but at a reduced monthly benefit. Delayed claiming means waiting longer for income to begin but offers a higher monthly benefit.

This image is property of s.yimg.com.

Impact on Spousal Benefits

Your decision to claim Social Security benefits can also affect your spouse.

How your decision can affect spousal benefits

Your decision to claim benefits early could reduce the amount your spouse gets if they’re planning on claiming benefits based on your work record. Likewise, if you delay claiming until after your full retirement age, it can increase both your benefit and that of your spouse.

Factors to consider for couples

As a couple, it’s essential to take into account the age difference, your individual health, the difference in your earnings, and your lifetime earnings when deciding when to claim benefits. It’s all about balancing your short-term and long-term needs.

Taxes on Social Security Benefits

When it comes to taxes and Social Security, it’s important to understand the implications.

Tax implications of working full-time while drawing Social Security

If you’re working full time and drawing Social Security, you might face additional tax obligations. Up to 85% of your Social Security benefits could be subject to federal income tax if your income exceeds certain thresholds.

Strategies to minimize the tax burden

There are several ways to minimize the tax burden, such as controlling your income from other sources, converting a traditional IRA to a Roth IRA, or investing in tax-efficient mutual funds.

This image is property of m.foolcdn.com.

Professional Advice on Drawing Social Security

Approaching an experienced professional can be of great help while navigating the complexities of Social Security.

Why you should consult with a financial advisor

A knowledgeable financial advisor can help you understand the rules and devise a strategy to maximize your benefits. They can provide tailored advice based on your individual circumstances and financial goals.

How professionals can help in decision making

Professionals can provide insights into the impact of various choices, help you understand the rules about working while receiving benefits, guide you on taxes, and even educate you about spousal benefits.

Taking an Informed Decision

The decision to draw Social Security at 62 while working full time should not be taken lightly.

Weighing the pros and cons of drawing Social Security at 62 while working full-time

Weighing the pros and cons is essential. While drawing early provides immediate financial support, it reduces your monthly benefit. On the other hand, working while drawing Social Security may lead to a temporary reduction in benefits if your earnings exceed the limit.

Common mistakes to avoid while making the decision

Avoiding common mistakes is key. One such mistake is failing to understand the impact of your decision on yours and your spouse’s future benefits. Another is not considering how your decision could impact your tax situation.

In conclusion, it’s possible to draw Social Security at 62 while working full-time, but it’s essential to make this decision strategically. Take into account your individual circumstances, financial needs, and tax situation before making a choice. And remember, seeking advice from a financial advisor can be very beneficial in making an informed decision.